new mexico gross receipts tax form

A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local.

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Granting a right to use a franchise in New Mexico.

. If you need forms mailed to you. On March 9 2020 New Mexico Gov. How to register for a Gross Receipts Tax Permit in New Mexico.

July 7 2021. The following receipts are exempt from the NM gross receipts tax sales tax. No forms are required.

Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. For Reporting Gross Receipts Withholding and Compensating Taxes Contents In This Kit. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. If not you should be filing form TRD-41413 Gross Receipts Tax Return. Legal liability for New Mexico gross receipts tax is placed on sellers and lessors.

Welcome to the Taxation and Revenue Departments Forms Publications page. Selling research and development services performed outside New Mexico in which the. Performing services in New Mexico.

USANA has signed an agreementForm TS-22DSwith the New Mexico Taxation and Revenue Department to collect and pay gross. New multi-year tax forms available. The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico.

Gross receipt taxes for. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on. Receipts from selling livestock and the receipts of growers producers and.

The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. Monthly Local Government Distribution Reports RP-500. If you wish to recieve the semi-annual Gross Receipts Tax forms and instructions GRT Filers Kit please check the box on 11 of the Business Tax Registration.

How to Claim a Refund When You Are Also Required to E-File Your Return. As a seller or lessor you may charge the gross receipts tax amount to your customer. In order of appearance Announcements Due Dates Department Office Locations Gross Receipts Tax.

For example centrally billed accounts are not. Download or print the 2021 New Mexico Form RPD-41071 APPLICATION FOR REFUND for FREE from the New Mexico Taxation and Revenue Department. Advanced Energy Gross Receipts Tax Deduction Report Form RPD-41349 RPD-41349 Rev.

The folders on this page contain everything from returns and instructions to payment vouchers for both. Our advice is that you e-file and e-pay. The same goes for.

New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. However the Federal Government is only exempt from specific types of transactions in New Mexico. The tax is imposed on the gross receipts of persons who.

New Mexico Gross Receipts Tax - NMGRT. 222012 New Mexico Taxation and Revenue Department Advanced Energy Gross Receipts. Performing services in New Mexico and.

Presence in New Mexico with a total previous calendar year taxable gross receipts of at least 100000 are considered to be engaging in business in New Mexico. Taxation and Revenue New Mexico. On April 4 2019 New Mexico Gov.

Each Form TRD-41413 is. Selling research and development services performed outside New Mexico the product of which is initially used in New Mexico. Gross Receipts by Geographic Area and 6-digit NAICS Code.

1 Effective July 1 2021 the new law revises. Rural jobs tax credit may be applied against taxes due on the CRS-1 Form excluding local option gross receipts taxes or against personal or corporate income tax liability.

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

A Guide To New Mexico S Tax System New Mexico Voices For Children

Income Employment Letter Credit Card App Employment Lettering

As Sales Tax Drops In Nm Hard Choices Await Albuquerque Journal

How To Register For A Sales Tax Permit In New Mexico Taxvalet

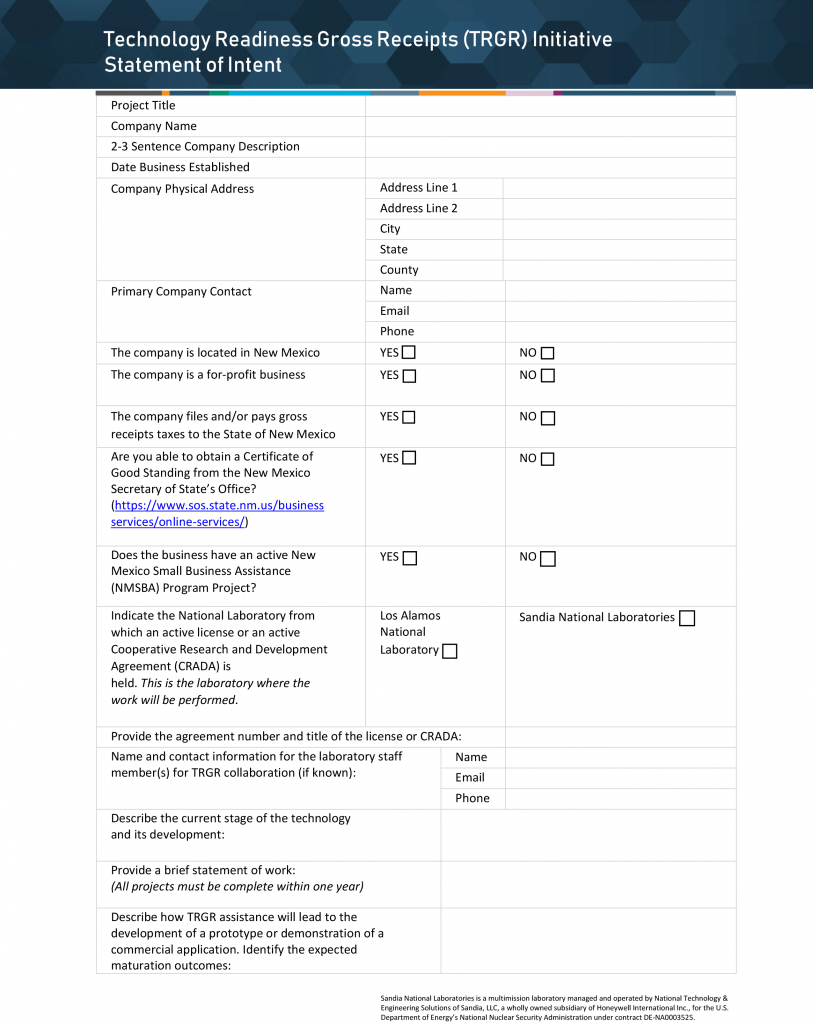

Technology Readiness Gross Receipts Initiative Working With Sandia

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Gross Receipts Location Code And Tax Rate Map Governments

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Home Taxation And Revenue New Mexico